The latest Forest 500 report makes it clear that no palm oil, soy, cattle or timber company that has committed to eliminate deforestation from their supply chains by 2020 will meet that goal.

Deforestation for oil palm in the Tanah Merah project, Indonesia.

Not one of the most influential

companies and financial institutions in key forest-risk commodities – palm oil,

soy, cattle and timber products – will meet their own 2020 deadline to

eliminate commodity-driven deforestation from their supply chains and

portfolios.

This is the verdict of the

latest Forest

500 annual report, published in March. The Forest 500 ranking, a project

run by conservation NGO Global Canopy, assesses the policies and commitments of

the 500 most important companies and financial institutions in terms of their

impact on forests. It includes 350 companies and the 150 financial institutions

with the largest exposure to them.

The commodities analysed by

Global Canopy are responsible for the majority of

deforestation driven by agricultural expansion.

Although nearly half of the

rank’s companies have made commitments to achieve zero deforestation in their

supply chains by 2020, “not one of [them] is on track” to do so, the report

says.

Global Canopy updated its

methodology for this latest report to better measure the extent to which

companies are effectively implementing their commitments.

Of 228 companies assessed over

the last two years, nearly 70% scored lower in 2018 than in 2017,

reflecting an implementation gap as companies fail to adopt more robust plans

to put their pledges into practice.

Almost a third of commitments

made by these companies make no reference to actions that are essential for

their effective implementation, such as monitoring suppliers, setting up

grievance mechanisms, and publishing details about suppliers or sourcing

regions.

According to the report, “the lack

of detail on how companies plan to execute their commitments clearly

illustrates the gap between setting ambitious public commitments and effective

implementation.”

Even companies that lead the

rankings on different commodities drop points due to serious deficiencies in

their implementation plans and actions.

The organisation’s most recent assessment is clear about these companies’ shortcomings on forest conservation.

More than a third of them are only focusing on one or a few of all the

forest-risk commodities with which they work (only 12% have company-wide

commitments).

“By either focusing commitments

on some commodities or regions, they remain exposed to deforestation in other

geographies or supply chains,” says the report.

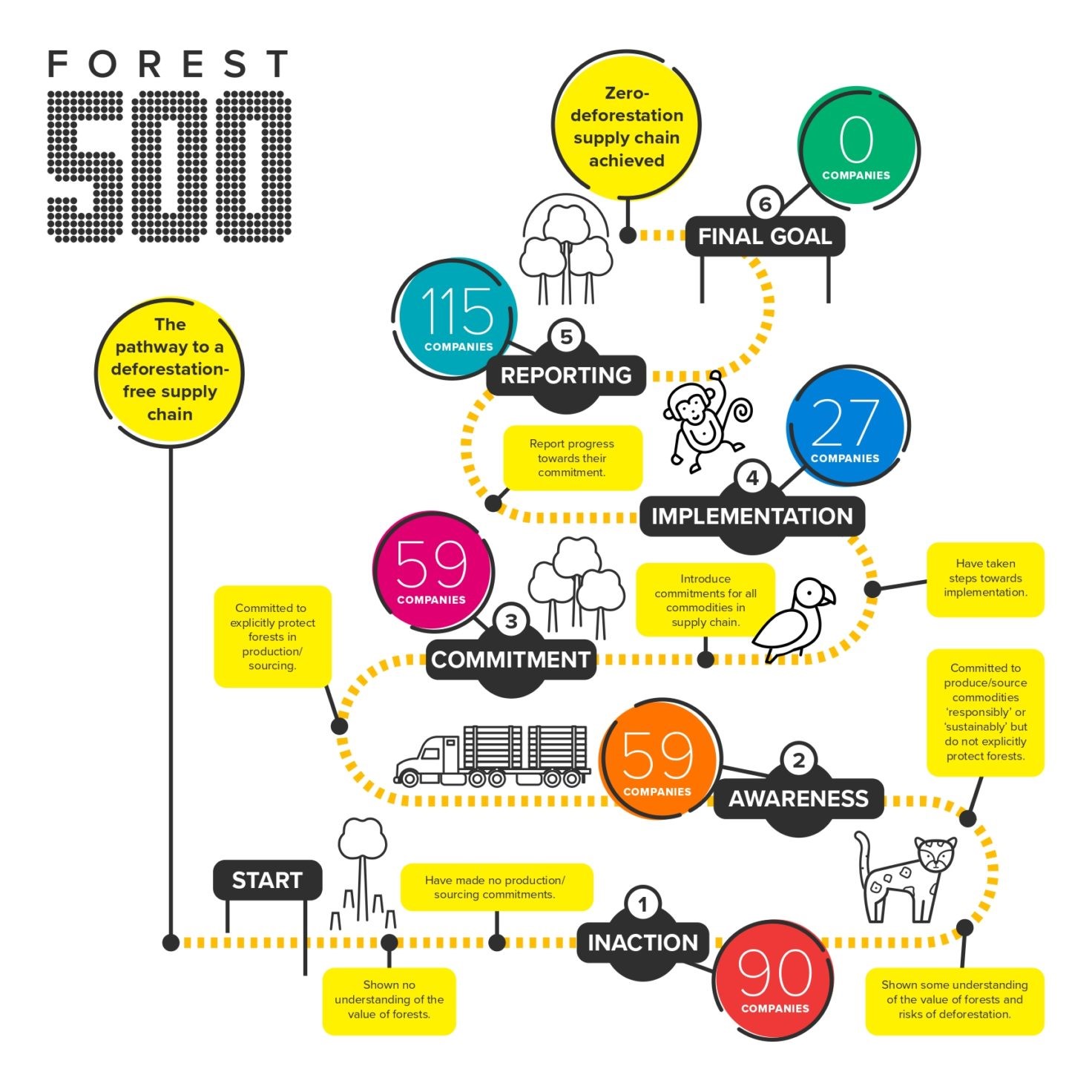

Numbers of companies at each stage on the pathway to a deforestation-free supply chain.

There is also a lack of

consistency. Some companies score high on some commodities but low on others:

while Unilever scores 89% on palm oil, it receives a disappointing 53% on soy. Mars scores 60% on soy but does not even appear on the

top ten companies for palm oil.

Worryingly, over 40% of

the companies in the rank have no commitments or very weak commitments. In

other words, they are not doing anything to tackle deforestation in their

supply chains.

Financial institutions and cattle

and soy companies lagging behind

The strongest commitments were found among palm oil companies. 42% of them have a zero-deforestation commitment. This likely reflects stronger public campaigns and media coverage of the environmental impacts associated with the commodity compared to soy or beef. But even here problems abound.

Palm

oil traders, processors and producers have weaker commitments than most

consumer brand producers, which undermines the latter’s efforts – however

inadequate these may be – to meet their zero-deforestation targets.

In other commodities, the situation is worse. No soy companies assessed disclose a list of soy suppliers or sourcing regions (compared to a quarter of palm oil companies).

Timber

companies are the ones least likely to report on implementation of their commitments,

raising questions about how they translate their pledges into action.

Companies in the cattle sector

fall even shorter: only 16% of them have forest-related commitments for

the beef or leather they produce or trade.

But the most notorious laggards are financial institutions. Of the 150 assessed, nearly two thirds had no financing policy for any of the four key commodities. None of the those that do scores high.

Of 123 financial institutions assessed in both 2017 and 2018, only

two had a policy around small-scale farmers. Ninety-seven of the institutions

do not have any commitments for the forest-risk commodities they finance. Only

nine have a policy for all the key forest-risk commodities.

While the 2020 goal cannot be

met, the report is clear that companies should not see this as an excuse for

procrastination.

Global Canopy supply chain

researcher Sarah Rogerson, the lead author of the report, has told Mongabay that

“it is crucial that companies raise their ambition and address the stark gap

between the promises they have made and activities on the ground.”

“Companies need to […] act with

urgency even if they are going to miss the 2020 deadline,” Rogerson said.

She is particularly concerned

about the glaring lack of action by financial institutions: “[They] need to

look at the companies in their portfolios and recognize that some of these

companies are driving deforestation and could pose a financial risk.”

Forest 500 companies repeatedly

featured on Earthsight over illegal deforestation and other crimes

In recent months Earthsight has frequently reported on several of the Forest 500 companies.

JBS, the Brazilian beef and leather giant which tops the rank in the cattle sector, has been implicated in a long list of illegalities and corruption scandals over the past two years.

This includes purchasing cattle

from illegally deforested areas and farms

implicated in slave labour,

sourcing livestock from the largest deforester in

the Amazon’s history, bribing sanitary inspectors to sign off on rotten meat,

and colluding with

top-level politicians, financial institutions

and other companies in shady deals to expand its business globally.

That JBS tops the Forest 500 cattle rank is a bitter reminder of the industry’s dismal environmental and social record.

While the Forest 500 report highlights a recent audit of JBS’s supply chain – commissioned by the company itself – that revealed a 99.97% compliance with sustainability and environmental laws, it ignores the fact that only last year a federal public prosecutor in Brazil found that nearly a fifth of JBS’s cattle purchases in 2016 presented some kind of irregularity.

Cattle being raised on a ranch embargoed by IBAMA, the Brazilian environment agency.

It also overlooks JBS’s own admission that

the company is still not able to monitor its indirect suppliers and that, among

Brazilian meatpackers, it stands alone as the one most exposed to

illegal deforestation and cattle laundering in the Amazon.

The palm oil sector, which had the best record of all commodities assessed, is also some way from achieving a sustainable future. In recent months SOCFIN, the largest oil palm planter in Africa, has been under scrutiny over alleged human rights violations and malpractices in West Africa despite pledges to clean up its act.

Musim Mas, one of the world’s largest palm oil producers and traders, reportedly sources crude palm oil and palm kernel from a plantation recently implicated in illegal forest fires in Central Kalimantan, Indonesia. Musim Mas was one of the eight highest scoring companies on the Forest 500 palm oil rank.

Feronia, a Canadian palm oil

producer financially backed by some of the largest development finance

institutions in the world, has been locked in protracted and violent conflicts with

local communities in the Democratic Republic of the Congo over the alleged

illegal occupation of their lands.

Malaysian giant Sime Darby has been accused of illegal land grabs in Liberia. Sinar Mas Group, one of Indonesia’s largest companies, was named in 2016 as one of several firms whose supply chains were tainted with palm oil fruit harvested from illegal plantations in protected forest areas in Sumatra.

Both

Sime Darby and Sinar Mas appear among the top ten companies of Forest 500’s

palm oil ranking.

Malaysian palm oil giants Wilmar

International, Asia’s leading agribusiness group, IOI Corporation and Felda

Global Ventures Holdings have also made recent appearances on Earthsight

over illegal deforestation and

labour rights violations.

Among soy producers and traders, the picture is no less worrying. Bunge and Cargill, two the world’s largest commodity traders, were fined a total of $29m by Brazilian authorities less than a year ago for buying grain from illegally deforested areas in the Cerrado.

Among major soy traders, the

two companies have been most closely linked to deforestation

in the Cerrado and the Paraguayan Chaco. Bunge is currently ranked fifth among

soy producers and traders on Forest 500.

The new results from Global

Canopy also lend support to the recent criticism by NGOs of the EU’s focus on

voluntary private sector action in its upcoming action plan on deforestation.

NGOs – including Earthsight – have argued that this

approach is misguided and would fail, and are calling for legally binding

regulations to be placed at the heart of the EU’s plan instead.