A recent report has exposed links between Swiss banks and some of the world’s largest palm oil plantation companies. Earthsight has reviewed the findings and shown that most of these firms have been involved in illegal deforestation.

Graphic showing the extent of Swiss financial firms' investments in palm oil

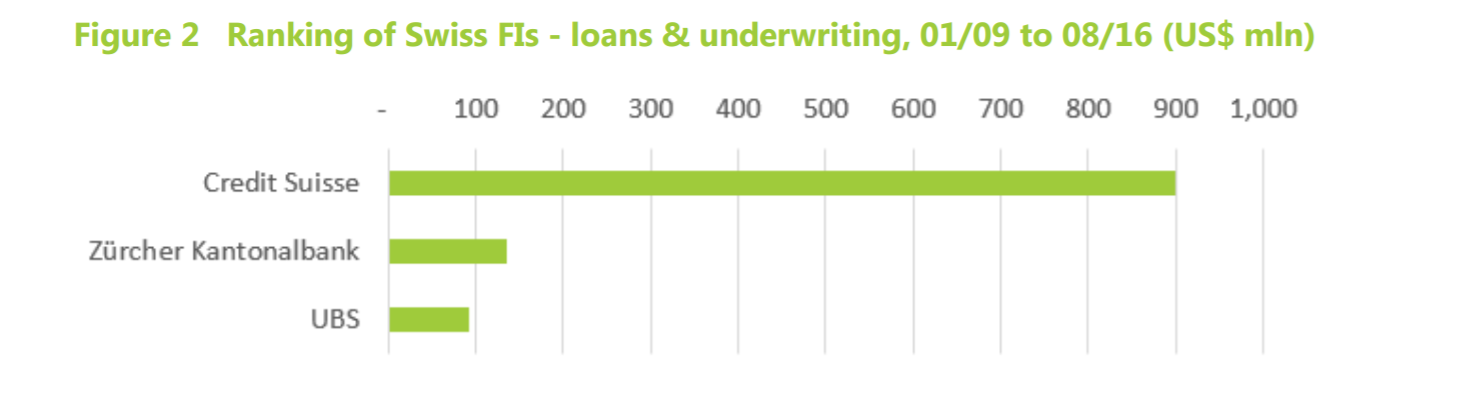

The report, written by Profundo for Swiss NGO Pain pour le prochain, found that 17 Swiss banks, including giants Credit Suisse, Zürcher Kantonalbank and UBS, had connections to major palm oil developer firms.

By far the biggest Swiss financier exposed by the study was Credit Suisse, which provided $901 million to palm oil firms globally between January 2009 and August 2016. Many of these firms have previously been exposed for illegalities in their projects.

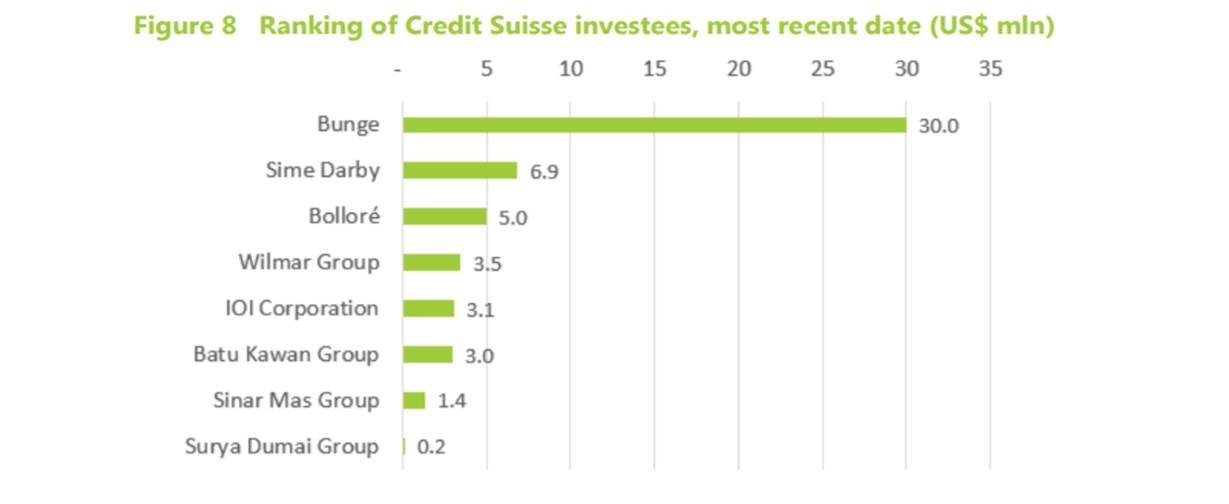

For example, Credit Suisse has $5m in shares and bonds in the Bolloré Group, which owns more than 38% of Socfin, the largest oil palm planter in Africa.

A 2016 Greenpeace report alleged that a Socfin subsidiary illegally cleared forest on São Tomé island, after satellite and field analysis showed the firm had felled 470 hectares outside its agreed concession.

The report also alleged

that the subsidiary had not conducted a satisfactory environmental and social

impact study despite the presence of endangered species, and had failed to

establish sufficient buffer zones around water courses within their concession.

Credit Suisse also owns or manages more than $3m in shares and bonds in the IOI Corporation.

Between March 2016 and August 2016, IOI’s membership of the Roundtable on Sustainable Palm Oil (RSPO) was suspended after the certification organisation’s investigation confirmed NGO allegations that the company had broken Indonesian laws at two of its plantations in Indonesia, including clearing land without required permits and clearing more land than authorised.

IOI is also entangled in a 10-year-old

dispute with indigenous communities in Sarawak, Malaysia, after it developed

palm oil plantations on their land without their free prior and informed

consent.

Graphic showing Credit Suisse palm oil investments.

Another $3m of Credit Suisse shares and bonds are invested in Wilmar International, which signed a zero-deforestation pledge in 2013. But footage recently obtained by the Rainforest Action Network shows illegal clearances taking place on an oil palm plantation that forms part of Wilmar’s supply chain.

An

excavator is seen tearing down forest and digging canals in the protected

Leuser Ecosystem, on the island of Sumatra, where the Aceh government has

imposed a moratorium on land clearing.

Sime Darby, in which Credit Suisse owns or manages $6.9m of shares or bonds, has been accused of illegal land grabs in relation to the development of oil palm plantations in Liberia.

In 2011, it was fined $50,000 by

the Liberian Environmental Protection Agency for breaching the terms and conditions

of its Environmental Permit during plantation development.

Finally, Credit Suisse also provided loans and underwriting worth $164m to the palm oil firm Sinar Mas. Sinar Mas signed a zero deforestation agreement in 2011 after a Greenpeace investigation exposed extensive illegal practices on their Indonesian plantations.

But, in 2016, they were named in an Eyes

on the Forest investigation as one of several firms whose supply

chains were tainted with palm oil fruit harvested from illegal plantations in

protected forest areas in Sumatra.